Chase Freedom Review: Bonus, rewards, and no annual fee

(This page may contain affiliate links and we may earn fees from qualifying purchases at no additional cost to you. See our Disclosure for more info.)

The Women Who Money Team wants to help women (and men) take control of their finances! Our goal is to empower you with the knowledge, skills, and tools necessary to improve your financial health.

This Chase Freedom credit card review was completed by Vicki, one of the co-founders of Women Who Money. She’s had the no-annual-fee Chase Freedom card for more than five years, along with three other Chase-branded credit cards. She enjoys earning cash back and other rewards. Vicki pays each credit card off at the end of the month to avoid paying interest.

My Experience With the Chase Freedom Card

I use a credit card to pay for almost every purchase I make. One of the credit cards I use frequently is my Chase Freedom card. I’ve kept it for years because it has no annual fee.

The Chase Freedom card also has rotating categories you activate each quarter. You can earn 5% cash back on combined purchases up to $1500 and 1% cash back on all other purchases. Maximizing the 5% bonus category in a quarter gets you $75 cash back on those purchases.

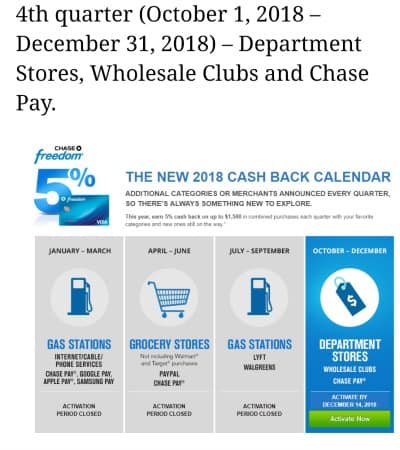

In 2018, some of the rotating categories earning 5% cash back included groceries, gas, wholesale clubs, department stores, and internet/phone/cable.

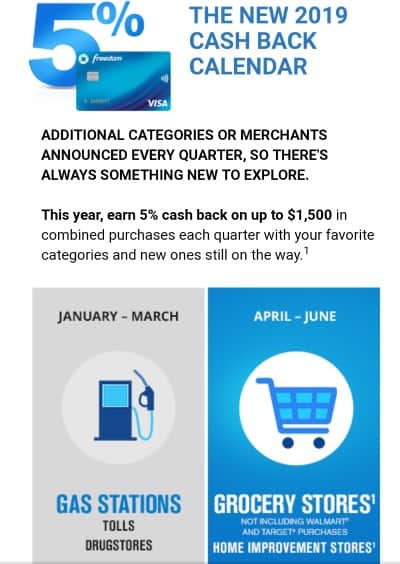

In the first six months of 2019, gas, groceries, drugstores, and home improvement stores are listed in the rotating categories. The categories for the last two quarters have not been publicized yet. But they often include some of the same types as the prior year.

We make plenty of purchases in the bonus categories on the Freedom card, so it is easy to earn 5% cash back at different times throughout the year. Some quarters we maximize the bonus, but we never spend extra to earn cash back.

We also make sure we can pay the bill off at the end of the month – otherwise, the interest owed negates the bonus!

Rather than take cash back, I allow my Freedom card bonuses to basically build as Chase “Ultimate Rewards” or UR points. I can then transfer those credits to my Chase Sapphire Reserve card account (that comes with an annual fee).

With UR points, I can get gift cards, book air travel, rental cars, hotels or a variety of other experiences. If you only have a Chase Freedom account, you can only get cash back from your purchases.

More Details About the Chase Freedom Card

At this point in time, Chase is offering 15,000 bonus points (redeemable for a $150 bonus) after you spend $500 on purchases in the first 3 months your account is open. But make sure you know what purchases count and the exact date the purchases need to be made by – or you might not be eligible for the bonus.

Also, read the fine print in the terms and conditions. If Chase finds you violated parts of your agreement, they can deny the bonus or take it back.

Besides having no annual fee, the Freedom card currently offers a 0% introductory APR for 15 months from account opening on purchases and balance transfers. After that, the variable APR is 17.24%–25.99% variable APR. The balance transfer fee is 3% of the amount transferred with a minimum of $5.

NOTE: This is all subject to change. Please make sure you carefully read any credit card offer you are thinking of applying for at any given time.

The Chase Freedom card also offers a variety of protection for you as a consumer. Zero liability, purchase, extended warranty, and fraud protection are offered.

Chase also offers up to $500 cashback per year by referring people to the Chase Freedom card. You earn $50 for each person who applies and is approved for the Chase Freedom card (up to 10 people).

Should I Consider the Chase Freedom Credit Card?

I rarely carry cash anymore, and because I use credit cards so often, I think it is important to “shop” for good credit card deals offering no/low annual fees, bonuses, or rewards – including cash back. That’s why I am comfortable recommending the Chase Freedom credit card.

If you don’t want to deal with the rotating categories, the Chase Freedom Unlimited offers 1.5% cashback on everything you buy.

I also check my statements carefully and pay off all of my credit card balances at the end of the month. If you run a balance on a credit card, it is important to look at the interest rate you are paying rather than the bonus you earn.

For some people, avoiding credit cards and using cash is the best answer to breaking the paycheck to paycheck cycle.

Have a money question, the team at Women Who Money will strive to answer it! Simply comment below or send us a note.