Napkin Finance: Money for visual learners [Book Review]

(This page may contain affiliate links and we may earn fees from qualifying purchases at no additional cost to you. See our Disclosure for more info.)

Are you a “hands-on” or kinesthetic learner who learns by doing?

Maybe your preferred way of learning is interacting through text when you read and write.

Auditory learners enjoy taking in information by listening to what others share.

And if you have a visual learning style, you prefer to see information and visualize the relationships between ideas

When it comes to learning about money and taking control of your finances, it’s important to seek out information that addresses how you learn best.

You can take action by tracking expenses with a spreadsheet and creating your own budget.

Reading personal finance books, articles, and blog posts and writing out your goals can help grow your wealth. And there are dozens of great podcasts you can listen to that teach about managing your money.

But many of the visuals describing financial concepts are confusing and complicated – especially for people who are just trying to learn the basics of personal finance.

That’s why I’m excited to share a review of Tina Hay’s new book Napkin Finance. If you learn best with pictures, diagrams, or charts, Napkin Finance – Build Your Wealth in 30 Seconds or Less is a great resource to teach you the basics about money and handling your finances.

Tina Hay and Napkin Finance

Tina is the founder and CEO of the education platform Napkin Finance.com. She holds a B.A. from UCLA and an M.B.A. from Harvard University. She has an impressive and diverse resume that includes work in film, technology, finance, and environmental issues. Tina’s also a successful entrepreneur.

Her goal with Napkin Finance is to help anyone make better decisions by simplifying money and finance. The platform was developed to help people understand money and complex financial topics in about 30 seconds or less.

In addition to her new Napkin Finance book, there is also a website with engaging content and actual physical napkins available to help people learn about money in a fun way.

According to their website, Napkin Finance “reaches over 80 million households through its collaboration with partners including JP Morgan Chase, UBS, and other financial institutions.” Their partnerships also work to bring financial education to financially underserved populations.

What You’ll Find In Napkin Finance

The book jumps right into the presentation of “napkins” to tell the story of a financial concept. But I don’t want you to get the impression that this is just a “picture book” either.

It’s definitely a comprehensive book for people who want to learn key vocabulary about money and personal finance.

Following each of the 60 napkins are a few pages of text giving easy-to-understand definitions, examples, quotes, fun facts, and key takeaways, for a total of 260 pages.

Here’s a brief look at the topics you’ll find in Napkin Finance and some of the important terms it teaches through napkin drawings.

Chapter 1 – Money 101 – The Basics

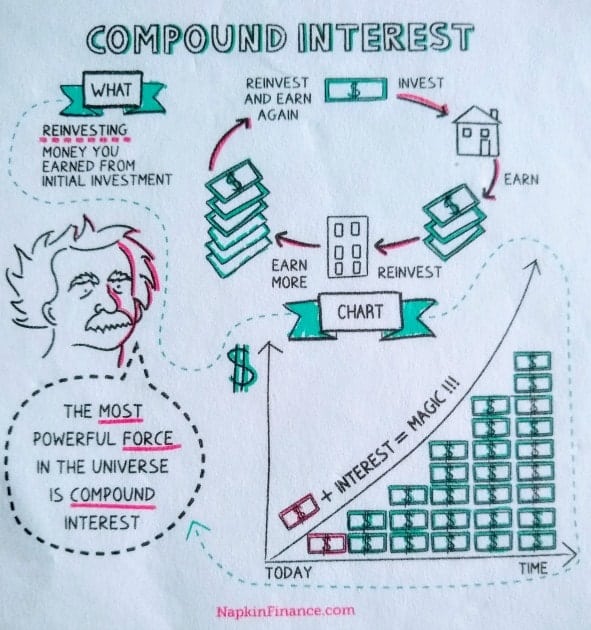

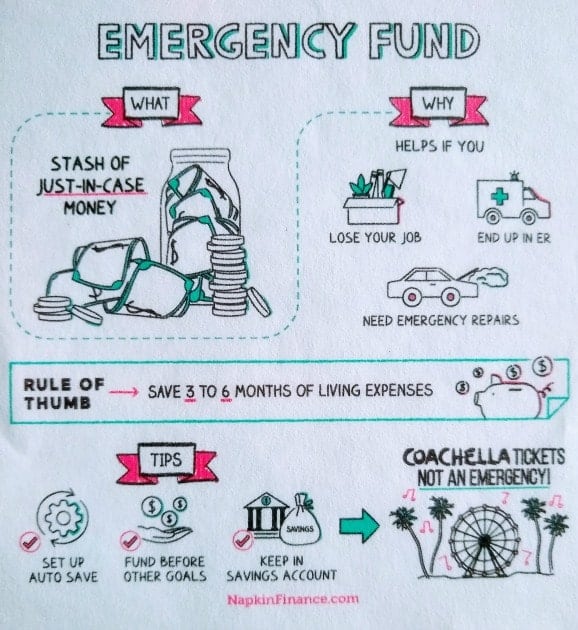

In this chapter, you’ll learn about compound interest, emergency funds, budgeting, insurance, and more. I really like the drawing of the “cycle” of how compound interest works – invest, earn, reinvest, earn more, and reinvest & earn again.

Chapter 2 – Credit Where It’s Due – Building Credit

Chapter 2 highlights a topic people new to controlling their finances really need to understand – credit. There are napkins on credit cards, credit scores, and improving credit. The one on FICO scores sums up the topic so easily in just a few quick sketches!

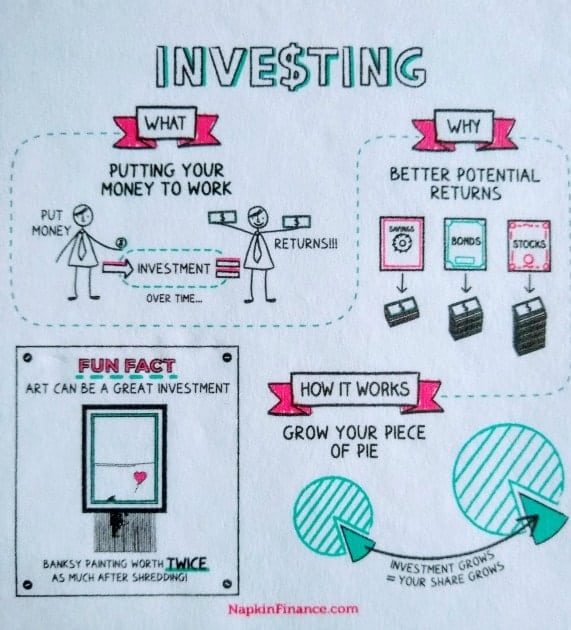

Chapter 3 – Buy Low, Sell High – Investing

In Chapter 3, you’ll find napkins on risk vs reward, asset classes, diversification, and robo-advisors.

The simple chart on investment types, risk levels, and reasons for investing can help move people from being stuck on what to do to taking action with their money.

Chapter 4 – Paying Your Dues – College

Chapter 4 focuses on a topic incredibly important to parents and students of any age! The napkins include paying for college, student loans, and 529 plans.

While explaining that college is incredibly expensive and helping you understand how to pay down federal loans, they also throw in some funny quotes to lighten the mood.

Chapter 5 – Into the Sunset – Retirement

While young readers might not be that interested in Chapter 5, the earlier they think about retirement, the better.

The topics discussed in the first four chapters will help readers understand napkins on Ira’s vs. 401k’s, Social Security, and estate planning.

Chapter 6 – A Wild Ride – The Stock Market

In Chapter 6, you’ll buckle in and check out napkins about the “wild ride” of the stock market.

Where should you invest? When? And how much should go where? In this chapter, you’ll learn about stocks, mutual funds, ETFs, bonds, and IPO’s.

Chapter 7 – EZ Does It – Taxes

Chapter 7 addresses something we all have to deal with each year – taxes.

Even though I’ve done my own taxes for years, the napkins on tax returns, W-2 vs. 1099 employment, and deductions were a good review of basic information.

Chapter 8 – Go Big – Start a Company

If you dream of being your own boss, Chapter 8 is for you. Napkins on entrepreneurship, business plans, and financing a start-up will help you learn more about small business before you give up your day job.

Chapter 9 – Voodoo Economics – The Economy

If you thought studying economics was too confusing or boring, the napkins on inflation, recession, and the Fed can help educate you without putting you to sleep or making you feel stupid.

Chapter 10 – The Bottom Line – Business

If you’re thinking about starting a business, Chapter 10 will help you get your finances organized so you can stay focused on your customers.

Napkins on income statements, balance sheets, and liabilities are important to understand if you want to run a successful business.

Chapter 11 – The Future of Money – Cryptocurrency

When it comes to reading about bitcoin, blockchain, and cryptocurrency – it all seems like a foreign language to me.

Even though I don’t consider myself a visual learner, I took away more from those napkins than I did reading articles on these topics.

Chapter 12 – Wow Your Friends – Cocktail Party Topics

I’m not sure if any of these topics come up at the parties you attend. But if you bring some of the physical napkins from Napkin Finance they might!

Set a glass of wine on a Rule of 72 or crowdfunding napkin and see if it gets your family or friends talking about money.

Learning Money on Napkins

As a 30-year educator, I really appreciate the Napkin Finance approach.

While I’m an auditory and reading/writing learner, I’ve worked with hundreds of students who would really struggle to learn about money with traditional book explanations or even by watching Youtube videos.

After showing this book to a visual learner I know who isn’t into personal finance, they said the diagrams and flowcharts are really easy to understand.

The concepts aren't full of “clutter” with a lot of text. They just make sense.

His comment was, “this was a book I needed in high school so that I didn’t feel like an idiot about money.”

While I agree this is a great book for high school students, I think it's a wonderful resource for anyone looking for simple explanations of financial concepts.

Remember, it’s never too late to take an interest in money and improving your financial health!

This book review was written by Vicki, co-founder of Women Who Money

Find more book and product reviews here