AgeUp Review: Helping You Fill Future Financial Gaps

(This page may contain affiliate links and we may earn fees from qualifying purchases at no additional cost to you. See our Disclosure for more info.)

This post is sponsored by Haven Life.

There’s a good chance you have family or friends who have lived into their 90’s. Or maybe even a few to age 100 or beyond!

The Social Security Administration reports approximately one in three 65-year olds today will live to be at least 90.

In 2020, there are an estimated 92,000 centenarians1 (age 100 or over) in the US. And there could be well over a half million people 100-years or older by 2060.

Thanks, in part, to advances in medical treatment and making positive changes to their lifestyles, a growing number of Baby Boomers will be retired for at least as many years as they were employed.

But that doesn’t mean they’re all spending their “golden years” traveling, playing golf, or lounging at the beach.

The news isn’t all good if you or an aging parent is a member of these generations.

While life expectancy has increased, there's no shortage of headlines declaring that people haven’t saved enough to cover twenty or thirty (even forty or more!) years of expenses in retirement.

When you combine increased longevity with reduced retirement savings2, disappearing corporate pensions3, possible reductions to Social Security benefits4, and rising healthcare costs5, you realize the financial challenges of many aging Americans.

That’s why it’s essential to think long-term.

You need to create a retirement “paycheck” with guaranteed streams of income to cover your expenses for the rest of your life.

AgeUp is a first-of-its-kind product designed to help close the financial gaps for many people who will spend decades in retirement.

Keep reading to learn more about AgeUp and why purchasing this product to improve cash flow might be a smart move for you or a loved one’s financial future.

Introducing AgeUp

AgeUp is an innovative longevity (or deferred income) annuity issued by MassMutual and sold by Haven Life Insurance Agency. An annuity is an insurance contract that generates regular income payments. Some describe annuities as pensions you can purchase.

Intending to help adult children purchase an affordable financial product to support parents or loved ones who live into their 90’s, AgeUp launched in late 2019.

A new self-purchase version of AgeUp launched in 2020 to help those in the 50-75 age range as they create a financial plan for their own futures.

How the AgeUp Annuity Works

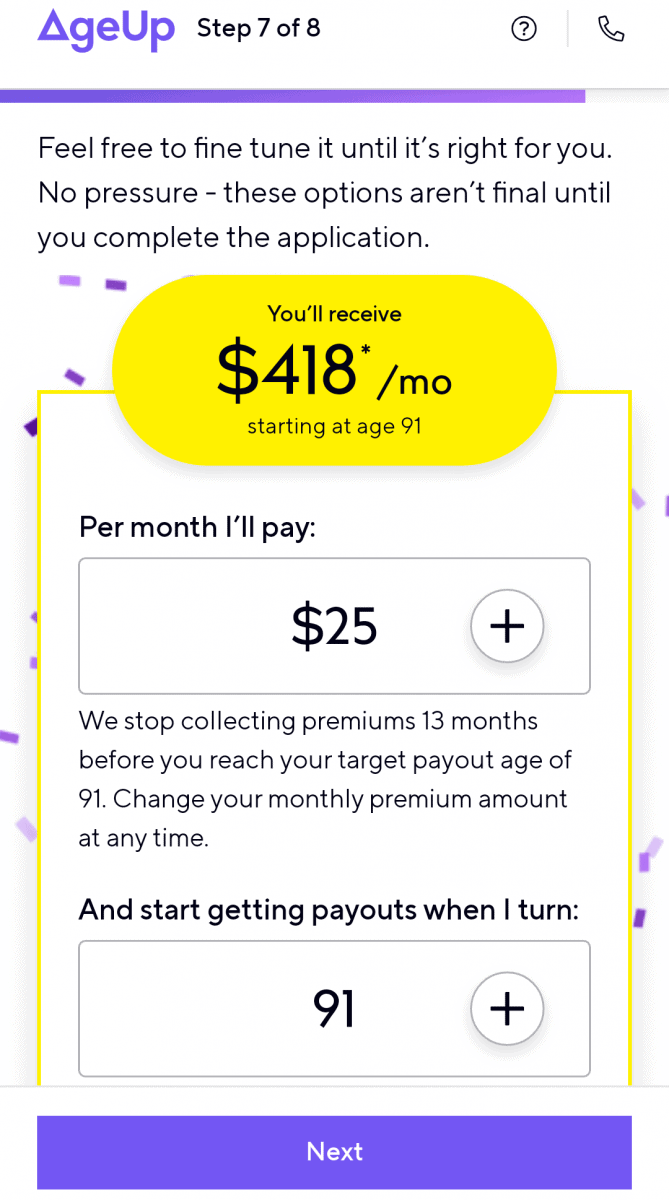

Monthly payments to AgeUp start at just $25 and buy a set amount of monthly lifetime income, beginning when the recipient reaches a chosen payout age between 91-100.

Unlike AgeUp, most longevity annuities (sometimes called longevity insurance) can only be deferred until age 85 and require a large lump sum to purchase.

AgeUp doesn’t require a physical exam or health information either. And benefits have no restrictions, so recipients have complete control over how they use this money.

If you’re concerned you’ll pay in for more years than you (or a loved one) would collect, it’s essential to try the AgeUp calculators to understand the monthly benefit payout based on your contributions and chosen options.

To reduce financial risk, you can select to have all premiums returned to a beneficiary if a recipient doesn’t reach payout age. While this does reduce the monthly benefit amount paid to the recipient, it guarantees the return of premiums paid.

There’s also a Cash Refund Guarantee if the recipient dies after payouts have begun. AgeUp determines the difference between premiums paid and payouts received and pays the difference to the purchaser or a beneficiary.

AgeUp is a flexible and affordable way to guarantee a slice of income for you or a loved one’s later years.

Obtain an Estimate

It only takes a few minutes to see an estimate of monthly payouts for an AgeUp longevity annuity.

To be eligible to purchase an annuity, the recipient (you or a loved one) must be between 50-75 years of age and live in one of the 44 states where AgeUp is available.

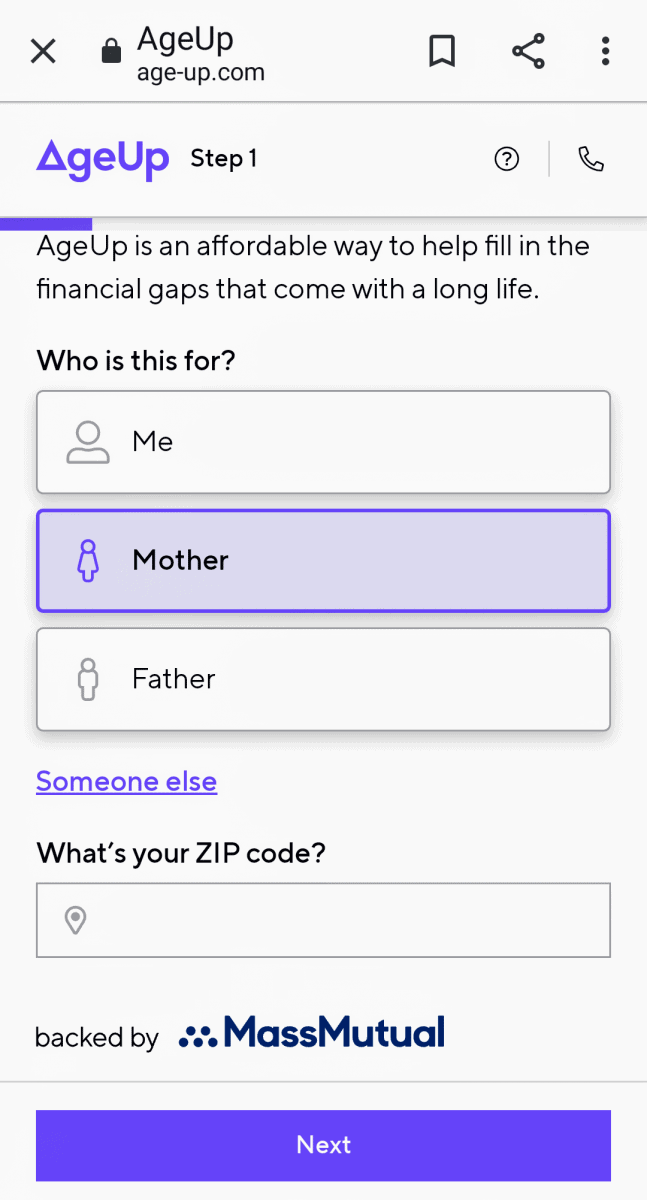

In Step 1, you’ll select who you are obtaining an estimate for, yourself or a loved one, and enter your zip code to confirm eligibility.

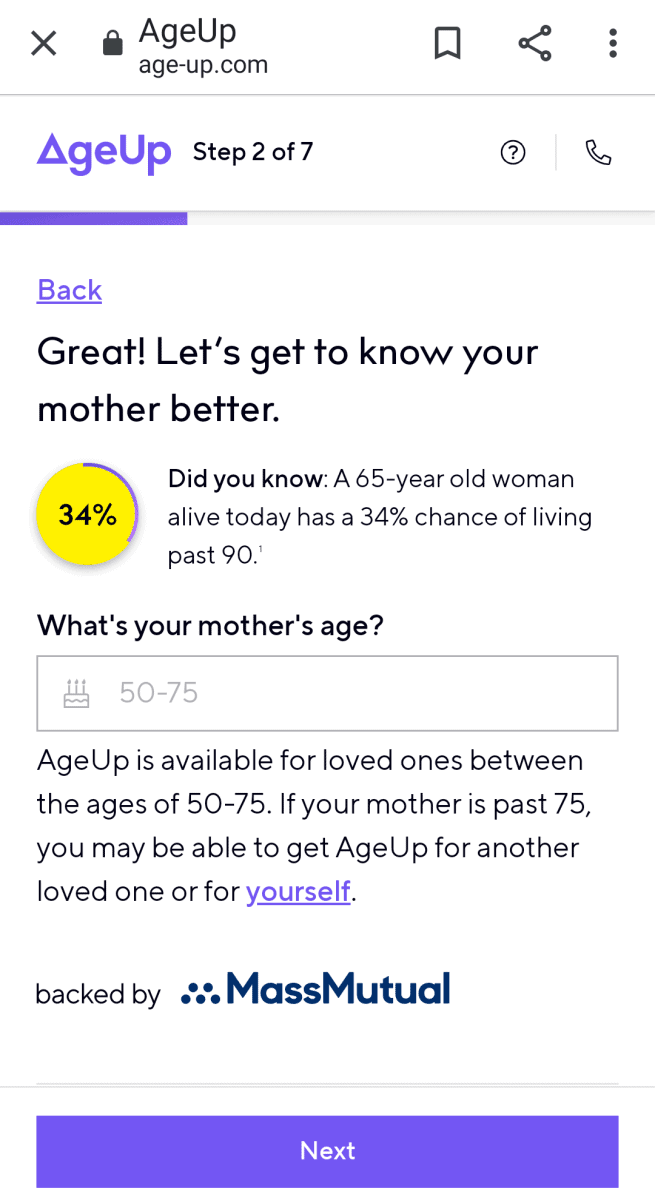

In Step 2, you’ll further select who the estimate is for, and enter the person’s age.

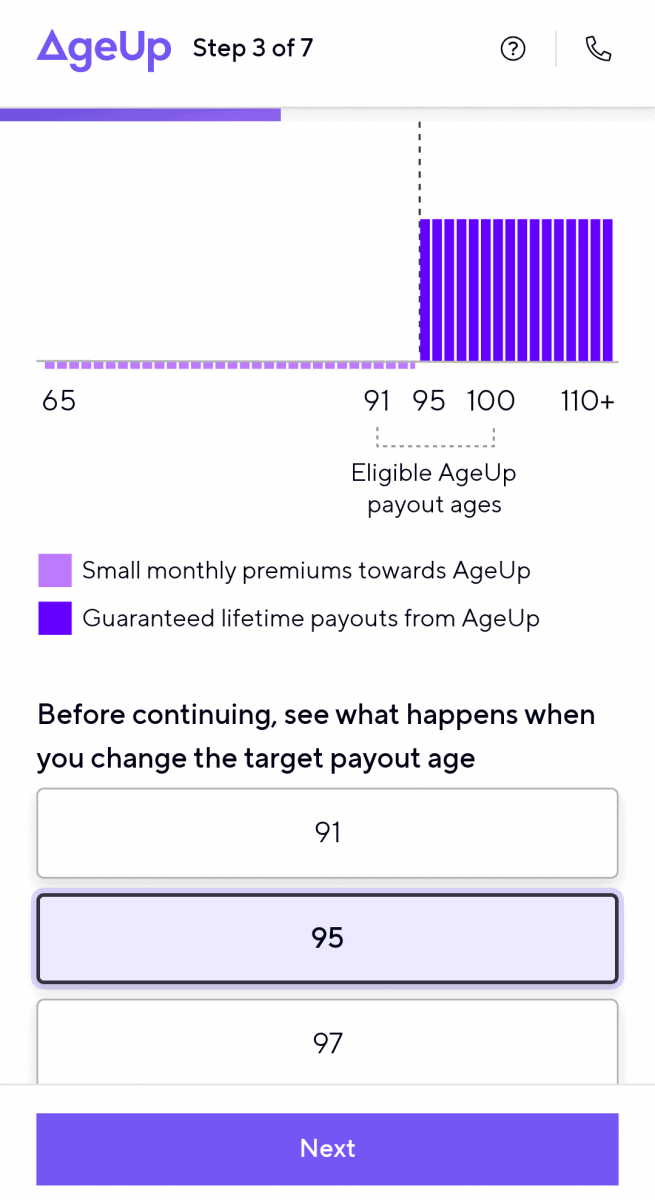

Step 3 depicts how monthly benefits change when you alter target payout ages.

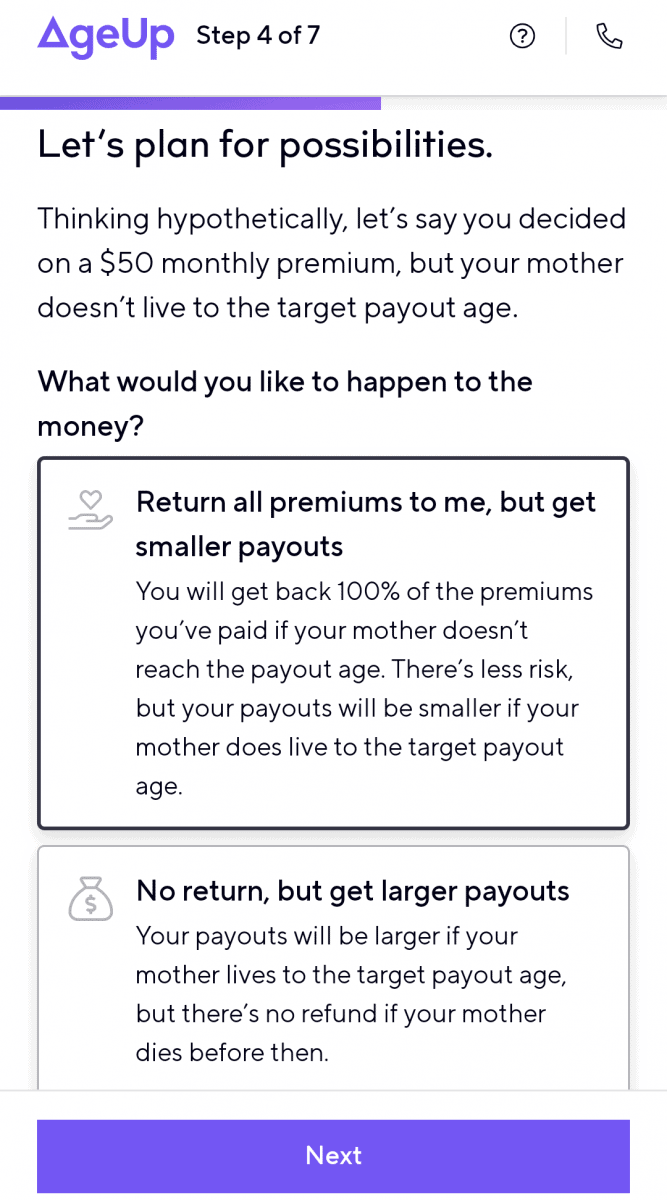

You’ll plan for the possibility of the annuity recipient not living to the target age in Step 4.

You can also estimate having all premiums paid returned to the payer (smaller monthly payouts) or see how much larger monthly payments would be if no premiums are refunded.

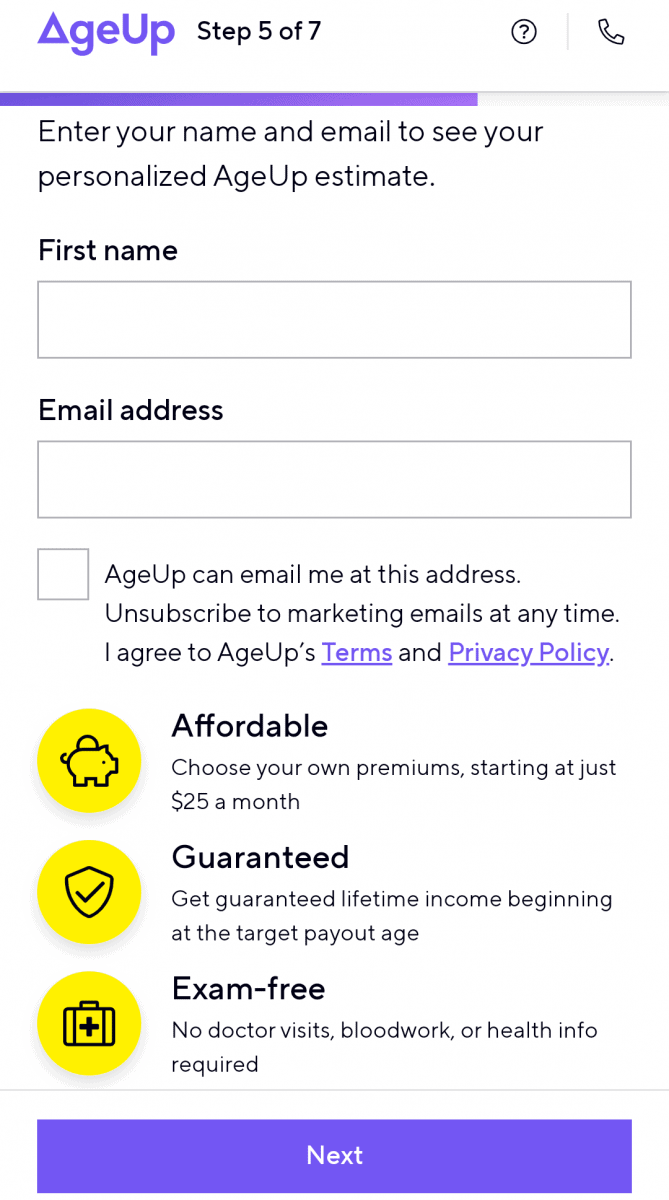

You’ll enter your first name and email address in Step 5.

You then receive your first estimate calculation. From there, you can adjust monthly payments and payout ages to visualize their impact on the recipient’s monthly benefit.

In general, you’ll get a higher monthly income stream benefit payout:

- the longer you pay premiums

- if you pay a higher monthly premium

- when you extend the target age for payout

- if you choose not to have premiums refunded in the event of recipient death before payout

More on AgeUp

The AgeUp website is comprehensive and provides customers with easy-to-follow directions and information about this new financial product. It also shows comparisons of AgeUp with traditional longevity annuities.

There are separate pages on the website explaining how AgeUp works if you purchase an annuity for yourself or if your interest is in buying one for an aging family member.

If you have questions and want to learn more about AgeUp, you can access their FAQ page, start an online chat, email, or schedule a phone call with a team member from AgeUp.

They also have a thorough AgeUp product snapshot you can download as a pdf document.

Pros & Cons of an AgeUp Annuity

Here are some of the benefits of adding an AgeUp annuity to your financial plan:

- Affordable premiums starting at $25/month (no initial large lump sum payment like other annuities)

- Flexibility to increase, reduce, or pause monthly premium payments

- No restrictions on how you spend payouts

- Can be purchased for yourself or a loved one

- No medical exams, health insurance, or other health-related questions required to qualify

- Optional death benefit

- Lifetime guaranteed income

- Safeguards against investment risk and longevity risk (outliving your savings)

- Cash Refund Guarantee when target payout age is reached

Some of the drawbacks to an AgeUp annuity include:

- You, your parent or loved one must be between the ages of 50-75

- Only available to residents in 44 states at this time

- Isn’t liquid like stocks or bank savings accounts

- You can’t cash in this product (no defined cash value)

- Changes to who’s covered by AgeUp, the target payout age, and choice for the “death before payout age” option are not allowed after purchase

Are There Other Options?

There are several other options to help you save money for your or your aging relative’s later years.

You can put money in a high yield savings or money market account. This is a low-risk option that provides you with flexibility. But it doesn’t offer a guaranteed lifetime income for the recipient.

Certificates of Deposit (CD’s) are another conservative savings vehicle but have little flexibility. While you’re guaranteed the principal amount you deposit, there's no lifetime income option.

Stocks and mutual funds provide your best chance to grow your money, but they also come with more financial risk if you need the money during a market downturn. Investing in the stock market also doesn’t provide an investor with a guaranteed lifetime income.

Women, Retirement, and Money

Women have unique challenges when it comes to retirement income planning. Longer life expectancies mean women need to plan for how to fund more years of retirement expenses.

- A woman’s financial situation in retirement is often negatively impacted by wage6 and investing gaps7.

- On average, women also collect lower Social Security benefits8 than men.

- Daughters also make up the majority of unpaid elder caregivers9 for their parents.

These are all reasons women run a higher risk of running out of money in retirement.

Women need to take control of their finances, determine streams of income, and plan for a retirement “paycheck” to cover expenses for their lifetime.

Longevity Calculators:

Final Thoughts on AgeUp Annuity

You have much to consider when planning long term and making financial decisions about retirement.

Annuities don’t make sense for everyone.

You probably don’t need one if your fixed retirement costs or long-term care are covered with other protected or guaranteed funds. Or if your retirement account balances are large enough to safely allow withdrawal of money to increase cash flow and fund gaps in paying for essential expenses.

Still if you worry you or a loved one may run out of money if you live beyond 90, an AgeUp deferred annuity may be a good option to add to your financial plan to guarantee a stream of income.

Paying a small monthly premium over a long period can be a smart financial move to improve cash flow for those in good health who have limited retirement resources.

Written by Women Who Money Cofounders Vicki Cook and Amy Blacklock.

Amy and Vicki are the coauthors of Estate Planning 101, From Avoiding Probate and Assessing Assets to Establishing Directives and Understanding Taxes, Your Essential Primer to Estate Planning, from Adams Media.

Sponsorship Disclosure

AgeUp is issued and backed by MassMutual, and sold by Haven Life Insurance Agency, a MassMutual-owned innovation hub. MassMutual has been in business since 1851 and is rated A++ for financial strength by A.M. Best10. For additional information, visit our website or check out our frequently asked questions.

AgeUp is a Deferred Income Annuity (ICC19DTCDIA) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111 and offered exclusively through Haven Life Insurance Agency, LLC. Contract and rider form numbers and features may vary by state and may not be available in all states. Our Agency license number in Arkansas is 100139527.

Sources/Notes:

1Number of people aged 100 and over (centenarians) in the United States from 2016 to 2060

2‘Alarming number’: Boomers struggle to save enough for retirement, survey finds

3‘It's really over': Corporate pensions head for extinction as nature of retirement plans changes

4The Future Financial Status of the Social Security Program

6Gender Pay Gap Report Key Facts

7Women Can Close the Gender Wealth Gap by Investing

8Cuts to Social Security would hurt older, single women most of all

9The Crisis Facing America's Working Daughters

10Massachusetts Mutual Life Insurance Company (MassMutual) and its subsidiaries C.M. Life Insurance Company and MML Bay State Life Insurance Company are rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of July 24, 2020 and is subject to change. MassMutual has received different ratings from other rating agencies.