Personal Capital is Now Empower: Best Free Financial Tools Review

(This page may contain affiliate links and we may earn fees from qualifying purchases at no additional cost to you. See our Disclosure for more info.)

Personal Capital is now Empower, and they are high on our list of must-have tools to manage your finances.

Whether you DIY your financial planning and utilize a robo advisor or seek portfolio management from a firm with financial advisory services, Empower has something (or many things!) for you.

This Empower review is by Amy, cofounder of Women Who Money. She's been actively using Personal Capital's now Empower's free financial tools since 2014 to aid her in managing her money and planning for a secure retirement.

What is Empower?

Empower is an online financial company headquartered in California.

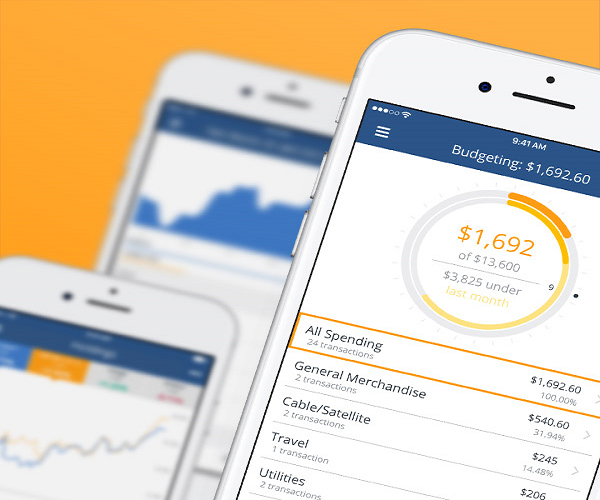

They offer a suite of free financial software tools, providing quick visibility and insight into your linked financial accounts, securely accessible on your desktop, laptop, or mobile device.

Empower also provides a team of financial advisors to help you grow and manage your personal wealth if you desire to become a private client.

- Personal Capital, now Empower, was Founded in 2009

- Currently has 17+ Million Customers

- $1.3+ Trillion Plan Assets Administered

- 71,000 Retirement Plans Under Administration

- 23 Best in Class Awards

Note: Security is a high priority for Empower, and they've partnered with industry leaders to keep your credentials safe.

Multiple layers of security – strong encryption, strict access controls, robust authentication, etc. – are used to keep all your private information, accounts, and you protected.

Additionally, money cannot be moved in, out, or between accounts you've linked to Empower. Not by you, Empower, or anyone else.

What are Empower's Free Financial Tools?

Empower provides a Financial Dashboard that pulls information from all your linked financial accounts into one convenient place for you to view and track, so you can make wise financial decisions, plan for the optimization of your wealth, and reach all your financial goals.

Via the Financial Dashboard, you can see your:

- Net Worth

- Cash Flow

- Account Balances and Transactions

- Budgeting / Spending by Account, Category

- Income Reports

- Spending Reports and Upcoming Bills

- Portfolio Balances

- Portfolio Allocations

- Key Holdings

- Investment Returns

- Top Gainers and Losers

- Projected Investment Fees

The Net Worth Calculator provides a complete view of your net worth at any time, anywhere, on any device.

Link all your bank, investment, retirement accounts, and other assets along with all your credit card accounts, mortgages, loans, and additional liabilities for easy tracking.

Analyze Your Portfolio

Speaking of investments, with the Investment Checkup tool, you can see how yours are performing. You'll also see how they may do better.

Your current investment portfolio asset allocation can be compared to an ideal target allocation designed to minimize risk and optimize returns.

You'll receive suggestions if you're taking too much risk (or too little) with your individual stocks, bonds, mutual funds, portfolio of ETFs, or other investment assets so you can make changes to achieve similar performance levels with an adjusted level of risk.

With the Fee Analyzer, you can quickly evaluate your mutual, index, exchange-traded funds, and other holdings to determine how expense ratios and hidden fees may be impacting your investment and retirement accounts.

Empower's fees can add up over time, and they may dramatically reduce your life savings.

Calculate and Plan for Retirement

Empower's Retirement Planner – “the most sophisticated, realistic retirement planning calculator available today” – allows you to see precisely where you are today in terms of achieving your retirement goals for tomorrow.

After inputting some basic information, such as your current age and anticipated retirement age, and your spouse's, if applicable, the tool helps you assess your retirement readiness using the financial information from your linked accounts.

It also lets you see how significant future expenses – children, housing, college, weddings, etc. – could impact your retirement savings plan.

On the flip side, it also allows you to see how additional sources of income – social security, rental income, pensions, inheritances, etc. – may affect your retirement.

Finally, the tool uses “robust modeling tools and Monte Carlo analysis of your actual spending and savings habits” to provide you with the monthly spending you can likely afford in retirement.

Why I Think Empower Rocks!

As mentioned above, I've been using the free financial tools and budgeting app since 2014.

At the time, I was a Mint.com user but began using them both because Mint lacked investment tracking at the time, and I wanted to try PC out before jumping ship on Mint.

Within six months, I chose Personal Capital over Mint and have never looked back. But you may wish to use both.

Now I use Empower several times per week to get a quick picture of my financial life.

I love being able to log in to just one place and view all my accounts – checking on transactions to ensure they are legitimate, keeping an eye on cash flow, and having a handle on credit card balances so there are no surprises.

Empower also comes in handy to verify the receipt of income in our accounts. And to ensure proper crediting of monthly bill payments on credit cards and mortgages.

Monthly, I use Empower to evaluate and record our net worth. And to do a quick overview of our investment accounts.

A few times each year, I look a little deeper into our investments using the Investment Checkup tool. All done in minutes.

While I don't use the budgeting features religiously, I do use them to evaluate our spending and ensure nothing is out of line.

Accessible on the Go

With their mobile app, Empower is available on your mobile device, making it even easier to monitor all our accounts.

It's so easy for me to open the app on my phone, securely log in, and check how the stock market is performing. Or see if the renter's paid the rent.

With the readily available information, it's also easy to discuss financial transactions with my husband and plan for our savings goals.

Empower Saved Us Money

When I first began using the app, the Fee Analyzer Tool helped me evaluate our retirement plan and investment accounts for fees.

Using the tool, I discovered funds within our 401k plans costing us a great deal.

After researching other investment options and making some changes, we now have our 401k plan annual fees under .10%; the benchmark is .50%.

Planning for Retirement

Empower's Retirement Planner tool provides me with an excellent overall check-in on our plans for the future.

With the ability to forecast different scenarios within our retirement and taxable accounts, I can see how the choices we make now or in the next ten years will affect us later in life.

While there are many other retirement calculators out there – and I do recommend you try more than one – Empower's tool provides valuable information in an easy-to-view format.

Empower Cash a High Yield Account

Empower Cash is a high-yield account offered by Empower. With this account, users can earn an interest rate higher than the national average, making it an attractive option for those looking to build an emergency fund and maximize their earning potential.

The money in the account is FDIC insured and accessible through Empower's mobile app or website.

Explore our Savings Planner – Your Complete Savings Solution.Is it all good?

Occasionally there are connection issues with your bank accounts or other financial institutions. But these have become less and less frequent and are resolved pretty quickly.

Most, but not quite all, banks, credit unions, mortgage companies, etc., sync with Empower. But synching issues are easily gotten around by adding the account manually.

For example, the mortgage on our rental property did not sync. So I simply adjust the mortgage balance monthly to keep an accurate picture of our net worth.

Empower offers financial tools free of charge. To make money, they charge fees for wealth management services based on the value of your assets under management.

As a user of the free tools, they may contact you, offering a free consultation with a human advisor. Some consider this an annoyance; I've just politely declined the meeting.

Add Empower Tools to Your Life

Empower provides wonderful money management and personal finance planning tools I think anyone can benefit from, and they're free!

I've been a fan of Empower from the start and don't see that changing. They're one of our most frequently recommended financial resources.

While there have been a few minor issues in the past, there are no significant negatives in my book. In fact, they keep uping their game.

Try Empower's Tools today, and let us know what you think!

Empower Personal Wealth, LLC (“EPW”) compensates Women Who Money, LLC, for new leads. Women Who Money, LLC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

Next: Using Your Values to Make the Best Money Decisions

Written by Women Who Money Cofounders Vicki Cook and Amy Blacklock.

Amy and Vicki are the coauthors of Estate Planning 101, From Avoiding Probate and Assessing Assets to Establishing Directives and Understanding Taxes, Your Essential Primer to Estate Planning, from Adams Media.