How to Have Better Money Talks With Your Partner

(This page may contain affiliate links and we may earn fees from qualifying purchases at no additional cost to you. See our Disclosure for more info.)

Research shows the more couples argue over money, the more likely their relationship is to break up over financial concerns.

Why? Because it’s about more than just money.

When you argue about money, you’re arguing about issues running deeper than the actual dollars and cents. And these are powerfully emotional issues that can make or break a relationship.

Looking deeper, when you argue about financial matters, you’re arguing about your beliefs, values, and goals in life.

Money issues also tend to magnify the levels of power and trust between couples. A money imbalance in relationships often causes dating people to separate or can even result in divorce in a marriage.

Couples & Money

When it comes to our finances, individuals can easily forget it's no longer just about them when they enter a romantic relationship.

Yet, to have a healthy relationship, your financial life needs cultivating too. To do that, you need to understand each other's thoughts and feelings about money.

Financial Beliefs

Everyone develops a set of money beliefs based on past experiences. Whether you realize it or not, your upbringing impacts how you think about and use money.

When you and your partner have contrasting beliefs, it can affect your relationship. Sometimes even causing a break-up.

For example, maybe your partner believes money should be used for status, while you think money should be used to create security. Or perhaps you want the kids to have the best of everything, and your partner believes that will spoil them.

Personal Values

The way you spend and save your cash is a reflection of your values and priorities. Your partner’s spending can make it seem like they don’t have the same priorities as you.

For example, if your partner spends a lot on going out to eat, but you want to use that money to save for the kids’ college expenses, there's a conflict in values expressed by how each of you wants to use your money.

Power Dynamics

Power differences in relationships are often related to money. And whether these power differences are real or perceived doesn’t matter if they cause problems between a couple.

Maybe there's a financial imbalance because one partner earns more than the other. Or one takes care of all the financial planning and bills without input from the other.

When one partner feels powerless and out of the loop, resentment, conflict, and even guilt can occur.

Note: If your partner is controlling your access to money you may be a victim of financial abuse.

Trust

Almost ⅓ of spouses admit to financial infidelity – lying to their partners about money. They spend secretly, lie about their bills (or debt), or hide cash.

When couples are dishonest about money and hide their financial problems, it’s difficult for them to trust each other in all areas of the relationship. This secrecy often leads to the relationship breaking up.

Debt

Though debt in itself isn’t an emotional issue, the cause of it can be. Debt, especially significant credit card debt or student loans, can be overwhelming. And high levels of debt cause high levels of stress.

If you aren’t able to deal with the emotional and financial stress, and the debt as a couple, it’s bound to take a toll on your relationship.

Prevent Money From Ruining Your Relationship

There are often signs of money issues in dating relationships, and this is the best time to work through them. Still, if you've already said “I do”, it's not too late to get on the same page about your finances.

Follow these steps for better financial communications.

1. Start the conversation

If you don’t already, you have to start talking about money. Many people consider money a “taboo” topic, but the healthiest, happiest couples routinely speak about their finances.

Start the money conversations in a neutral place; when you have the time and energy to focus on what each of you has to say.

It doesn’t have to be all seriousness – but be sure and put the phones down. Make it a date and start with a few fun questions to get the conversation going. The goal is just to start.

Still, make some rules for your financial conversations. No blame or accusations are allowed. No interrupting your partner. Respect each others’ thoughts and opinions.

Remember, it’s about more than money, and this is the person you love.

Sample questions to get you started:

- What are our goals for the next year? What about 5 and 10 years from now? (Individual and shared goals)

- What did you learn about money growing up?

- Where do we stand right now? (What’s your current financial situation? This might require a little homework)

- How do you feel about debt – yours, mine, or ours?

- Where would you like to see our extra money go – savings, spending, etc.?

- How do you feel about the money inequality between us? (If one of you earns significantly more or holds significant debt)

2. Understand your past

Your past experiences influence your mindset and beliefs about money.

Think (and talk) about what impact your past has on your current situation. And try to understand how your partner’s history affects their views.

How the adults in either of your childhood homes managed money made an impression on you both, good or bad.

Identifying and discussing those impressions can help you both understand and accept your current beliefs and actions, while also highlighting what needs to change.

Prior relationships either of you had and the financial dynamics in them can also impact your present attitudes about money in a relationship.

3. Accept and work with differences (compromise!)

When it comes to your financial life, you might not agree with your partner 100%. You might even have individual as well as combined financial goals. That’s okay.

The key is to openly talk about your differences, compromise, and figure out how to make things work for both of you.

There will always be differences in how you each use and think about money. Yet if you’re open about it, and can find common ground, financial issues won’t snowball into a mountain of troubles.

4. Be honest

Trust and honesty are an integral part of a healthy, happy relationship. Be transparent about everything related to your finances, from your credit score to your bank statement to your debts.

Spending in secret or stashing money cash away from your partner will only make things worse.

If this is new to you, it will be difficult at first. But when you commit to regularly talking about your finances, it gets easier. You’ll feel closer to your partner as a result.

5. Prioritize shared and personal life goals

Ultimately, personal finance is deciding what goals you will prioritize.

As a couple, discuss what you aspire to do in life, individually and as a couple. This is where you talk about lining everything up: money, values, and goals – together.

- Do you want to buy a home?

- Have children?

- Travel the world?

- Pursue a college degree?

- Quit your 9-5?

- Start a business?

- Become financially independent?

Start with the end in mind. Align your life goals and values with your finances and create your mission statement.

When you make life decisions together, it’s easier to get on the same page, financially and otherwise.

6. Continue the conversation

Keep the conversation going, and don't hide any financial problems. The more you talk about your relationship with money as a couple, the easier it gets.

Make a point to have financial conversations with your partner each week. Keep reviewing your goals to keep motivation high.

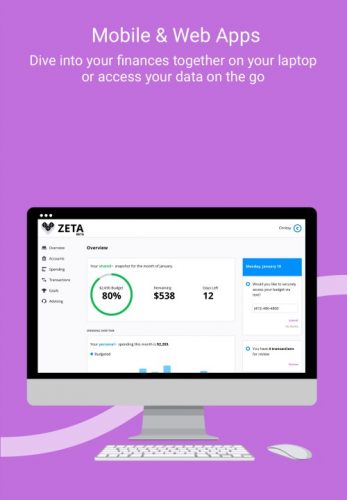

Finally, consider using a personal finance app to track your finances together such as Mint, Personal Capital, Tiller, or Zeta.

Zeta is a tool specifically designed for couples, that can help you reach your financial goals together.

Should you keep your money separate?

It depends. Everyone has a different opinion, and each situation is unique. Some believe married couples should combine finances, others think separation is important.

One option many people use is a combination of ours-mine-yours, wherein there's a joint bank account for household and family expenses and smaller separate accounts for personal spending.

Ultimately, what works for one couple doesn’t necessarily work for another. Separate finances or not, you’re a couple, which means all decisions should be team decisions.

Create a system that works for you and your partner

It might work best to have finances separate, combined joint accounts, or a combination of the two.

When you don’t know yet what works best for your relationship, try different methods, and see what sticks.

If the way you're doing things isn’t working, change it. Keep talking and trying new things until you find something that you both like.

You might also consider speaking with a relationship therapist, a financial planner, or a money coach to help you get on the same page financially.

Lastly, remember this when working through financial issues in your relationship, money itself does not bring happiness.

Money is merely a tool for building your life and financial freedom, and for reaching your dreams and goals.

Next: What Financial Protections do Stay at Home Parents Need?

Article written by Amanda

Amanda is a team member of Women Who Money and the founder and blogger behind Why We Money. She enjoys writing about happiness, values, money, and real estate.