How to Avoid Mistakes in Retirement Planning

(This page may contain affiliate links and we may earn fees from qualifying purchases at no additional cost to you. See our Disclosure for more info.)

One of the best rules of thumb for retirement planning is to start saving early and never prematurely touch the money you've earmarked for retirement.

If you’ve waited to start saving, haven’t saved enough, or have borrowed against your retirement accounts, all is not lost.

Even if you’ve made one of these frequent mistakes made when planning for retirement, you still have time to set yourself up for a more comfortable retirement.

Even if retirement is only a few years away.

As the Chinese proverb goes, “the best time to plant a tree was twenty years ago. The second best time is now.”

Common Mistakes in Retirement Planning

Besides not investing in your future at all, the following are traps you might easily fall into when laying out your financial plans for life without a job.

1. Underestimating the Cost of Health Care

An analysis by RBC Wealth Management estimated that the lifetime future healthcare costs for a 65 year old retiring couple would be more than $660,000.

While Medicare will cover about two-thirds of that cost, retirees will be responsible for the rest, or around $220,000. Even more with a long life expectancy.

With such overwhelming numbers, how do you begin to save enough for retirement with the cost of healthcare factored in?

One way you can prepare for higher healthcare costs once you reach the traditional retirement age is to fully fund an HSA (health savings account) now.

If you have a high-deductible healthcare account with an HSA attached, save as much as you can in your HSA for future healthcare costs.

The money is tax deductible when you put it in an HSA, enjoys tax free growth, and isn’t taxed when you pull it out.

If you can leave your HSA money in your account without touching it, allowing it to grow, then you can have a substantial amount to put towards your healthcare costs in retirement.

2. Not Saving Enough

Bankrate reports that 52% of US workers worried they had not yet saved enough for retirement (and 20% weren’t sure how much they had saved).

One of the biggest retirement plan mistakes is to delay investing for retirement in favor of paying down debt, saving for a house downpayment, or buying a car.

But how much do you need?

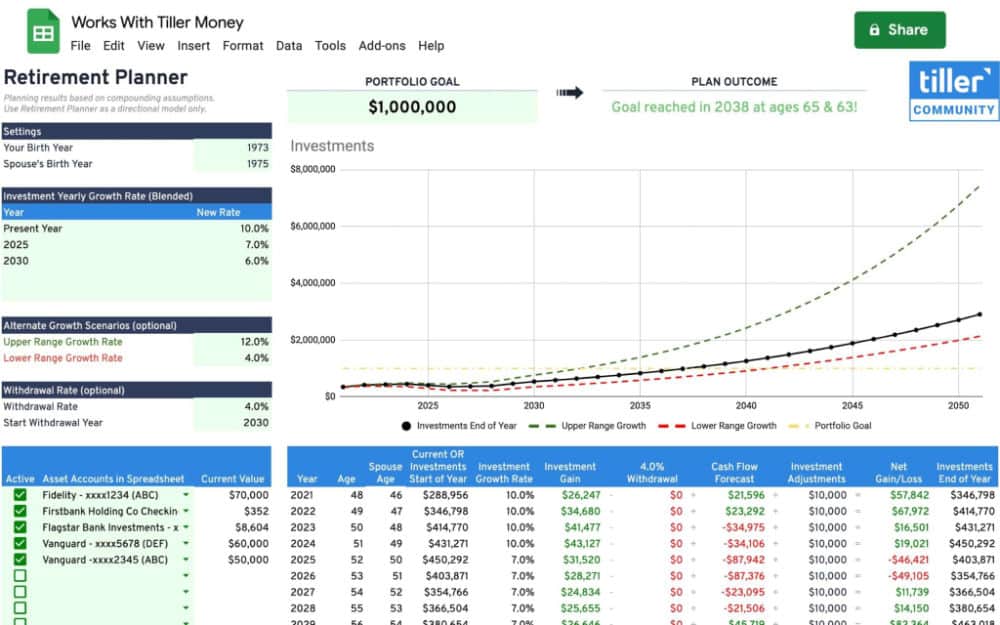

There are tons of retirement calculators to help you figure out how much to save, here's one from Vanguard. But the easiest rule of thumb is that you’ll need 25 times your yearly expenses to fund your retirement.

If you don’t know your annual living expenses, a simplistic approach is to estimate them by using 80% of your family’s pre-tax income.

Once you know that (probably large) retirement number, you can subtract the yearly amount you’ll receive from other sources. The amount left is what you need to save.

Potential retirement income streams could include a Social Security retirement benefit, pension, rental property income, or from holding a mortgage on the sale of your home.

If you’re not even close to saving enough to reach that number by retirement, there are some ways to increase your savings rate.

First, change your thinking about retirement savings.

When you invest more for retirement, you’re keeping more of your hard-earned money out of the hands of the government.

If your company offers a 401k, then you’ll receive some sweet tax benefits for every dollar more you contribute.

For every $1,000 more you save in your traditional retirement account, you’re decreasing how much you pay in taxes. So your take-home pay will be more than you think.

If increasing retirement savings feels too hard, take a long-term approach.

Start by saving just 1% more this year. Then every time you get a raise, increase your retirement savings by at least half of the raise percentage.

If your raise is 3%, save 1.5% more for retirement. If you get a fat 5% raise, save 2.5% more for retirement.

You’ll still receive more money in your paycheck, plus you’ll slowly increase your savings percentage.

Even if it takes you years to max out your retirement contributions annually, you’ll be saving more than you would have otherwise.

Also, make sure your saving is automatic. If you save in a 401k or 403b, talk to your HR representative about increasing your percentage each year.

When using an IRA, set up an automatic monthly contribution, and discipline yourself to never decrease how much you invest.

Once you reach the age of 50, you're eligible for catch up contributions, too, so don't forget to increase the amounts you send to your eligible tax-advantaged accounts.

Further Reading: What To Do If Retirement Savings Is Not Yet Enough

See and track your net worth with our powerful FREE Empower Personal Dashboard™

3. Saving for College at the Expense of Retirement

An important financial rule of thumb is to ensure you’re saving enough for your retirement before saving for your kids’ education.

College can be funded in a myriad of ways. But if you’re short on retirement savings, there’s often nothing you can do to make up the deficit. This is especially if you’re too old or too sick to keep working.

Also, while college may last 4-5 years, your retirement will last more like 20-30 years.

Young parents may put saving for their later years off, thinking they have plenty of time to start.

But it’s important to begin saving for your retirement as early as possible to take advantage of the effects of compounding.

The longer your money is invested, the more chances it has to grow based on the interest rate you’re earning.

Because you won’t need as much money for your kids’ college, it’s not as crucial for you to begin saving early. Although ideally, you would save for both financial goals.

Before you start saving money for a child’s education, make sure you contribute as much as you can in a 401k or IRA.

If you worry you won’t be able to save enough for both, go ahead and start modestly on both fronts, favoring your retirement investments.

Make sure you’re contributing enough to get the employee match in your 401k or start an automatic withdrawal to your IRA, working to increase the amount you contribute each year.

Then, open a 529 account for each child. Commit to saving a small amount, even $25 per month per child, to start funding higher education for your child.

Once the fund is open, you can encourage friends and family to give your children 529 contributions for birthdays and holidays.

4. Robbing from Yourself

In a Bankrate survey, 49% of workers with retirement accounts admitted to withdrawing money before retirement.

When you borrow from or cash out money in retirement plan accounts, not only do you potentially pay a heavy withdrawal penalty, you cheat yourself out of valuable years of market growth.

Even if you take out a 401k loan and pay the money back, you’ve lost out on critical years of compounding by removing your money from the stock market.

While 401k plan sponsors may allow for loans that can provide favorable interest rates, there are some big disadvantages.

If you leave your employer or suffer a layoff, your loan has to be paid back within 60 days generally.

If not, the IRS will consider the loan a 401k distribution, and you’ll have to pay taxes plus a 10% penalty on the balance owed.

Although retirement account loans can seem like a good idea with low interest rates, remember that you’re not just borrowing from your current balance. You’re robbing yourself of future income in retirement.

You’ll likely take years to pay the loan back. And will probably never make up those retirement contributions at a later date.

Instead, if you’re tempted to take a loan out from your retirement account, assess whether you can live without that loan.

- Could you buy a smaller house?

- Drive your old car for a few more years?

- Find a loan with a slightly higher interest rate that won’t rob you of market gains?

It’s essential to adopt the mindset that your retirement accounts are sacrosanct and shouldn’t be touched for any reason unless you’re retired.

5. Starting Too Late

When you’re just starting out in the workforce, it’s easy to overestimate the number of years you have to save for retirement.

But the Rule of 72 tells us that the longer our money is in the market, the less we have to devote overall to get significant returns.

Even saving modest amounts when you’re young can translate into a considerable balance in your retirement account when it’s time to leave the workforce.

If you haven’t yet started saving for retirement, go ahead and set up a retirement account.

If you have a 401k (or 403b for non-profits) through your employer, that usually means sending an email to HR. Or making changes on the website of the financial institution holding your account.

There are several places you can set up an IRA and commit to funding a set amount each month, say $50 or $100. Here are a few:

If you can begin to save for retirement, even small amounts, then chances are the pride of watching your accounts grow will propel you to save more and more each year.

6. Planning to Work Forever

In a survey conducted by American Advisors Group, a reverse mortgage lending company, 18% of older Americans surveyed said they never planned to retire.

In comparison, nearly half (46%) said they planned to work part time after retiring from a full time career.

While working forever might sound good in theory (or not!), the reality is that working forever is just not feasible for many Americans.

As the pandemic has shown us, many people are retiring earlier than expected, not later, because of physical or mental health, reorganizations at work, or because their finances allowed it.

And while 72% of workers think they’ll do some sort of work after retiring, only 30% report actually doing so.

Instead of expecting the same standard of living or higher in your later years, make plans now to minimize expenses and adjust your standard of living so you’re able to retire.

That might mean:

- paying off your mortgage

- increasing the amount of your retirement contributions (which lowers the amount of each paycheck and teaches you to live on less

- practicing eating out less

- reducing other unnecessary expenses

to save and invest more for your eventual retirement.

7. Forgetting an Estate Plan

You may not think of an estate plan as part of your retirement strategy, but it should be.

When you die, your estate goes to the probate court system. Even if you don't have a will or there’s not much to it. Probating will tie your assets up for months if not years.

Creating a will makes sure the people you want to end up with your hard-earned assets do. So it’s a great start to an estate plan on top of purchasing adequate life insurance.

When you have a substantial amount of assets you anticipate leaving to your loved ones, then you might want to consider setting up a living trust.

It’s also a good idea to set up a living will to ensure that your wishes will be respected if you become sick.

For everything you need to know about estate planning, check out Amy and Vicki’s easy-to-read new book, Estate Planning 101.

If you haven’t created a will or trust yet, make it a priority this year. Also, consider finding a local attorney to help you with the ins and outs.

There are even low-cost legal programs, often available through your employer, that can help you create an estate plan very inexpensively.

Other Mistakes to Keep in Mind

There are several other errors that can be made when striving for financial security after retiring. Consider these as you work on designing your future retirement income.

- Not anticipating long-term care needs – consider self-insuring or long term care insurance, while Medicare may be available, it's likely not what you'd choose.

- Taking Social Security before full retirement age – the sooner you chose to (or have to) take your SS retirement benefit, the less you'll receive each year.

- Adopting a conservative investment strategy too early – a very low risk tolerance can equate to a very low investment return which keeps you working longer, while adopting more investment risk when you're young for a bigger rate of return can help you reach financial milestones faster.

- Putting all your eggs in one basket – a diversified investment portfolio is generally best to mitigate risk. Earn 5% Fixed Interest with Worthy Bonds

- Forgetting about inflation – a high annual rate of inflation means your dollars have less spending power than it does in years with a lower inflation rate.

- Ignoring one time or infrequent costs that will come up – consider these common budgeting mistakes when putting together your retirement budget or using a retirement calculator.

- Tax implications – tax rates change, and yours will probably be different in retirement than it is now; still, it's easy to underestimate your future tax burden, so don't put off obtaining investment advice or tax advice from a professional if this is an area you struggle with.

- Not planning for the next chapter of your life beyond the finances – creating a financial plan and retirement goals is more than deciding on your retirement contribution today for a certain monthly income in your golden years. Don’t forget about your health and how you’ll spend your time.

Final Thoughts

With careful planning to avoid these common errors, you can make sure you’re on the right track to retire and not fall short of your other financial planning goals.

While there's a chance you'll over save to avoid making any retirement planning mistakes when designing your strategy, there's a greater chance your retirement fund could expire before you do if you ignore this list.

A little financial education and preparation are required to achieve long term goals like a successful retirement.

But your future (retired) self will thank you for setting your retirement portfolio up for success today. Your kids will appreciate it too.

Next: Saving for Retirement While Helping Kids & Parents

Article written by Laurie

Laurie is a team member of Women Who Money and the founder of The Three Year Experiment, a blog about building wealth in order to become location independent.